Hospitality and leisure sectors often have sundry invoices for miscellaneous costs like occasion fees, catering extras, or customer penalties. The use and nature of sundry invoices differ throughout industries relying on the kind and frequency of miscellaneous transactions. Knowledge analytics tools provide insights into sundry earnings and expenses, helping businesses establish trends and make knowledgeable monetary selections. Proper submitting of invoices, receipts, and correspondence helps audit readiness and tax compliance. Coaching supplies or academic sources purchased sometimes for workers development could be invoiced as sundry objects.

From regulatory compliance to audit integrity and financial transparency, the way you manage these seemingly small transactions speaks volumes about your financial https://www.kelleysbookkeeping.com/ discipline. Sundry gadgets usually involve foreign money difference—, especially reimbursements, forex adjustments, or intercompany billing. Cloud invoicing tools can convert currencies in real-time using accurate exchange rates and record the difference as sundry gain or loss.

Enterprise Internet Options: Dedicated Vs Shared Connection Options

- Examples of sundry bills include varied business-related prices such as office supplies, journey expenses, promoting prices, legal fees, and repairs and maintenance.

- Sundry expenses examples can include journey prices, gasoline, gifts, donations, or small one-time charges.

- As An Alternative, their balances are aggregated beneath sundry creditor accounts to maintain the accounting data streamlined.

- Sundry revenue is all about irregular revenues that don’t assure long-term earnings or a company’s revenue.

- These bills play a pivotal function in making certain the operational efficiency and longevity of facilities, affecting budgetary concerns and general management methods.

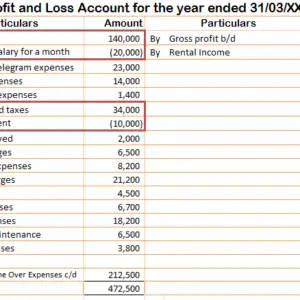

Recording one-time costs in ledgers has several advantages regarding taxation. When you think about sundries in your revenue and loss account, you possibly can offset income tax and corporation tax payments. Just merely creating a sundry bills account within the accounting ledger isn’t sufficient for a business to effectively control them. In regular business, many petty expenses are incurred for the graceful sundry accounting functioning of the business.

Sundry invoices may also come up from interdepartmental activities, changes, or accounting corrections—especially in larger organizations. Chip Stapleton is a Sequence 7 and Collection sixty six license holder, CFA Level 1 examination holder, and currently holds a Life, Accident, and Health License in Indiana. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. Such periodic expense critiques help in figuring out unnecessary or overpriced services, thereby permitting for renegotiation of vendor contracts or in search of various suppliers. They enable for an in depth expenditure evaluation, revealing areas the place minor changes can result in considerable financial savings. For instance, the enterprise incurs an expense for printing a new sign for the office but the accountant posts this expense to the ‘Sundry Expenses’ account, rather than the ‘Printing’ account.

What’s The Difference Between Sundry Bills And Miscellaneous Expenses?

This comprehensive approach contributes to transparent, dependable, and environment friendly accounting that helps long-term success. Businesses should forecast cash circulate by incorporating anticipated sundry income and bills based on historic data. Though sundry transactions could be unpredictable, analyzing previous developments can enhance forecasting accuracy. Regular audits of sundry invoices and related documentation assist guarantee compliance with accounting standards and tax rules. Guarantee that sundry invoices are recorded promptly and accurately in the accounting system.

Sundry Expenses Vs Common Bills

Each sundry transaction ought to be correctly documented to make sure transparency and understanding. This easy approach ensures that companies deal with even the smallest particulars with precision and readability. When you hear the time period “sundries,” you might marvel, “What precisely does that mean? ” Regardless Of being a time period not generally used in everyday dialog, sundries play a significant position in each private and business contexts.

Similarly to sundry expenses, there may be additionally sundry earnings – earnings that is irregular and doesn’t align with the regular earnings categories. Regular monitoring of sundry expenses may help you keep away from the oversight of rising prices, preventing seemingly insignificant prices from becoming unexpectedly problematic. It’s all about staying on prime of these expenses and adapting your accounts to fit your business’s wants.

Basic expenses are the costs a business incurs as part of its daily operations, separate from promoting and administration bills. Examples of common expenses embody rent, utilities, postage, provides and laptop equipment. Sundry invoices are sent a company’s prospects who hardly ever make a buy order on credit score and the quantity of their purchases are not significant. Now let’s assume that a buyer bought shoes in another country and desires to return them in America, however the exchange price leaves the company with extra revenue.

From pens and paper to toner cartridges and desk organizers, businesses rely on this stuff to facilitate smooth operational processes. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across a quantity of industries. The agency focuses on making ready personal and company taxation while offering fractional CFO work and leading the accounting and finance perform for a number of small-to-medium-sized businesses. In his free time, you’ll discover Jason on the basketball court, travelling, and spending quality time with family.